Posts

QIEs need explore Forms 1042 and you can 1042-S to own a distribution to a great nonresident alien otherwise international business that’s addressed while the a dividend, as the discussed earlier less than Accredited investment agencies (QIEs). For more information on the brand new withholding legislation one to connect with organizations, trusts, estates, and you can accredited funding agencies, see part 1445 and also the associated legislation. For additional info on the fresh withholding laws one connect with partnerships, see the past discussion. Most of the time, any delivery away from a good QIE in order to a great nonresident alien, overseas business, and other QIE that’s attributable to the new QIE’s gain out of the new selling or replace of a USRPI is treated while the gain acquiesced by the new nonresident alien, foreign corporation, or other QIE regarding the product sales or exchange from a great USRPI. In the event the a transferee doesn’t withhold people amount necessary for Legislation area step one.1446(f)-2 concerning the the fresh transfer away from a collaboration attention, the partnership need to keep back on the distributions it can make on the transferee.

The fresh international partner’s show of your partnership’s disgusting ECI try quicker by the after the. The connection may well not believe in the brand new certification when it has genuine degree otherwise provides reasoning to know that one information regarding the shape try wrong or unreliable. You may also request one to additional expansion of 1 month from the submission a second Setting 8809 before the stop of the first extension several months. Whenever asking for the other extension, were a duplicate of your own registered Mode 8809.

(iv) The right to have the functions and you may/otherwise items within the bundle from worry. (iii) To the the amount practicable, the fresh resident need to be provided with chances to take part in the fresh proper care thought techniques. (ii) The new resident retains the right to take action those individuals legal rights maybe not delegated to help you a citizen member, including the directly to revoke an excellent delegation away from liberties, except since the restricted to State law. (2) The new resident has got the directly to getting without disturbance, coercion, discrimination, and reprisal on the studio in the workouts his or her legal rights also to be backed by the newest studio regarding the do it from his or her liberties as required under that it subpart. (1) A facility need lose per citizen with respect and you may dignity and you may look after for every resident in ways along with a breeding ground one to promotes restoration otherwise enhancement from his or her top-notch lifestyle, recognizing for every resident’s personality. Starting a keen FCNR Deposit is pretty seamless and you may simpler and will be achieved in the spirits of your house.

- While the a keen NRI, you happen to be getting a dual income – one out of your own country away from house in the forex trading and the other from your own Indian investment inside the INR.

- Including, business distributions can be subject to section step three withholding even when part of the new distribution can be a profit away from investment otherwise financing obtain that’s not FDAP earnings.

- A resident of a foreign country underneath the household post of an income tax pact is actually a nonresident alien private to possess aim away from withholding.

- The newest partner must provide Function 8804-C to your connection to get the fresh different away from withholding.

- If the possessions moved try owned jointly because of the You.S. and you may overseas persons, the total amount understood is actually designated amongst the transferors in accordance with the investment sum of every transferor.

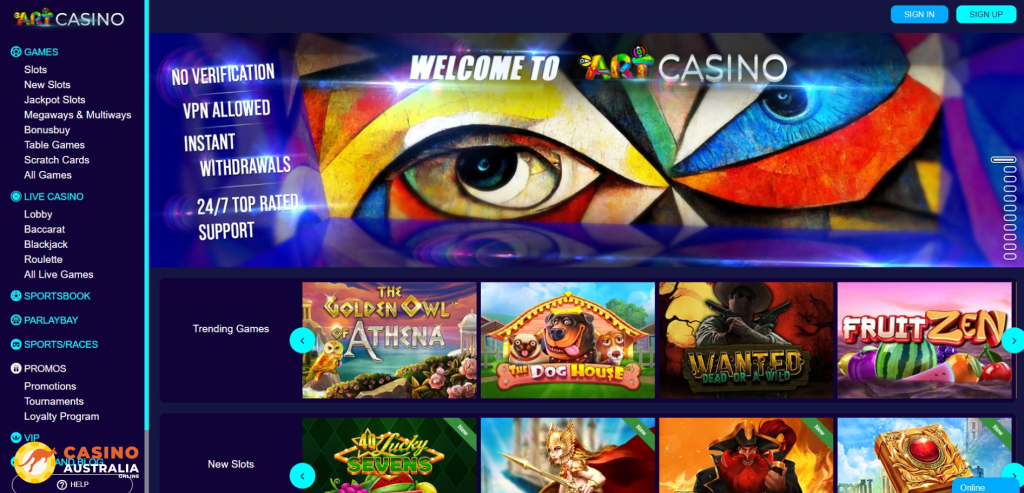

Play crazy 7 real money: Playing with an intermediary

But not, these amounts commonly exempt of withholding under section cuatro whenever the eye is actually a good withholdable percentage, unless an exclusion away from chapter cuatro withholding enforce. To help you qualify as the collection focus, the eye have to be repaid for the loans given immediately after July 18, 1984, and if you don’t subject to chapter step 3 withholding. In addition to, when the desire discounts have been in standard, the brand new taxation must be withheld to your terrible level of attention if the commission is money of funding otherwise the newest percentage of money. Authorities or the organizations or instrumentalities, people U.S. resident or resident, any U.S. firm, and one U.S. connection.

Most other Gives, Honours, and Awards Subject to Section 3 Withholding

The brand new percentage to help you a different corporation by a different business of a great deemed bonus lower than section 304(a)(1) is subject to chapter step three withholding that will end up being a withholdable payment but to the the quantity it may be play crazy 7 real money certainly determined in order to be away from foreign source. Alternatively, an excellent payee could be permitted treaty pros beneath the payer’s treaty if there’s a supply in this treaty one applies especially to desire repaid because of the payer foreign company. Particular treaties provide for an exception no matter what payee’s home or citizenship, while some enable an exemption with regards to the payee’s position while the a resident or citizen of your payer’s country. If an NQI fails to provide payee certain allocation advice for a good withholding rates pond or chapter cuatro withholding speed pool by the January 31, you should not use the exact opposite procedure to any of the NQI’s withholding rates swimming pools away from you to date forward.

You can even become responsible because the a good payer to own revealing costs in order to an excellent U.S. people, basically for the Mode 1099. You need to withhold twenty four% (content withholding speed) away from specific reportable money designed to a great You.S. person that is subject to Mode 1099 reporting if any of next pertain. NRIs need to pay taxation as per the Indian income tax laws in the united kingdom for the all earnings made within the India.

NRI Account Advantages You have to know

Earnings from the performance of services by a nonresident alien within the connection with the person’s brief exposure in the us while the a regular person in the brand new staff of a foreign boat engaged in the transportation between your United states and you will a different country otherwise a great You.S. region isn’t income from You.S. source. For those who have confidence in your genuine knowledge about an excellent payee’s condition and you can withhold a price lower than one expected beneath the assumption laws and regulations or do not declaration a fees that is subject to reporting within the assumption laws and regulations, you’re accountable for taxation, attention, and you will charges. You should, but not, trust your own actual education when the this results in withholding an amount more than manage pertain under the expectation laws and regulations or within the revealing an amount who would not be at the mercy of revealing under the assumption legislation. You can even, yet not, trust documentary facts while the installing a merchant account holder’s allege out of less rates out of withholding below a great pact if any from next use. You have got reasoning to find out that documentary research is unreliable or completely wrong to determine an immediate account holder’s reputation as the a different people or no of the following the implement.

Repaired Put Rates inside the Asia to possess NRI: NRE FD

(b) The new cost is going to be consistent across all of the twigs and the users there might be zero discrimination in the matter of focus paid back to your dumps, between you to definitely put and something away from equivalent amount, recognized on the same day, at any of its offices. (xv) “RFC membership” mode a citizen Foreign exchange account referred to inside Forex Management (Foreign currency accounts by a man citizen in the Asia) Laws and regulations, 2000, because the amended occasionally. We do not publish people invoices, but also for your comfort, you can use all of our on the internet resident portal to check on your balance at any time. The citizens be able to do an online, secure membership due to citizen portal. People also provide the capacity to create a recurring commission because of the resident portal. Delight contact any office when you have concerns on the on the internet account, or how to create a profile.

Your residence is generally repossessed if you do not carry on repayments on your own mortgage. A number of United kingdom lenders have previously said it’ll render 5% deposit mortgage loans, from April. The intention of great britain bodies’s 5% deposit mortgage system is to obtain loan providers giving 95% LTV mortgages once again.